What if we are diagnosed with cancer and need to pay $8,000 a month for treatment?

That’s what Ms A, one of my clients, is going through right now.

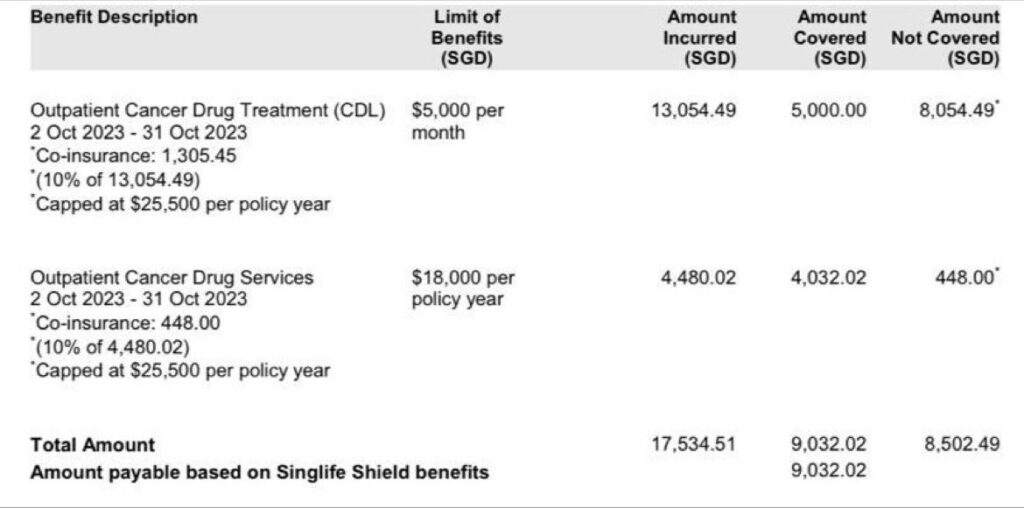

She has an integrated shield plan with a rider, but it only covers a fraction of her outpatient cancer drug treatment.

She is shocked and confused.

How can she afford such a huge amount every month?

How long will the treatment last?

How will this affect her family and her future?

She is not alone.

Many people are unaware of the gaps and risks in their insurance plans, and they do not have the proper coverage for their needs.

They may think that they are well protected, but they may be in for a rude shock when they face a critical illness or a major medical event.

They may end up paying a lot of money out of their own pocket, or worse, they may not be able to afford the treatment that they need.

This is why we need to have a comprehensive and regular review of our insurance portfolio, and to get the adequate coverage that we need.

We also need to stay updated with the changes of the certain plans, especially for the health care insurance.

The insurance industry is constantly evolving, and the plans that we have today may not be the same as the plans that we will have tomorrow.

The benefits, premiums, terms and conditions, and exclusions may change over time, and we need to be aware of these changes and how they affect our coverage.

Don’t wait until it is too late.

Don’t let an unforeseen event ruin our life and our dreams.

Don’t let a lack of adequate coverage put us and our family in financial hardship and emotional stress.

Disclaimer:

For illustrative purposes only.